Kiva, use of technologies and micropayments to benefit many

Kiva It is an initiative of volunteers who set up in 2005 a project based on micropayments using the potentialities that technologies now offer. Eventually it was formed into a San Francisco-based, non-profit organization with a mission to connect people through loans to alleviate poverty. Leveraging the Internet and a worldwide network of microfinance institutions, Kiva allows individuals to lend as little as $ 25 to help create opportunities around the world, as the following example shows:

The need: There is a lady who 200 miles from Lima, requires the equivalent of 900 dollars to supply her small grocery store, and is willing to pay for it.

The opportunity: There are people in many parts of the world who would be willing to give $ 15 to projects like this, if she will pay them. Another 100 dollars, another 40 cents, etc. And even more attractive if it will have a return as a loan.

The solution: Kiva implemented a platform through which people can see the lady's data, her economic condition, her environment, what she aspires to, and contribute whatever is at will. Once many add and reach the goal, the lady receives the money, signs a payment commitment with a microfinance company that promotes the project in Peru, and will be paying monthly. She receives her loan, and those who lent her will have it back.

It is an interesting alternative for those who aspire to loans and also for those who have a few dollars that instead of giving them to a stranger at the corner of the traffic light can help people to get ahead. All projects apply to human development processes, such as housing improvement, strengthening of small businesses, completion of studies or new ventures.

I like the model: Find a need, loan it, get paid, do it again. Although it amazes me how they brought such a simple idea to a global environment.

Over time Kiva has reached more than 800,000 people, 62 different countries, more than 330 million in loans and an 98.94% repayment rate.

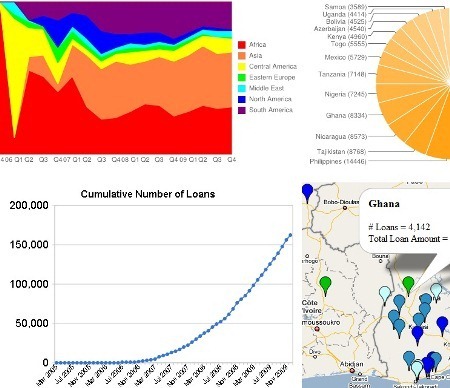

Once inside the platform, you can search by country, by amount and also Kivadata, Which shows interesting statistics on the behavior of this model and other interesting applications included for mobile.

Interestingly, you can see the progress of a loan application and on a map you can see where people are collaborating.

So, it doesn't hurt to join. Either because you have $ 5 in PayPal with which you can't find what to do, or because sooner or later you could apply for a loan.

Registration is free.

Temporarily, if you promote other people to register you will receive 25 dollars in bonus, which you can not use for your expenses but you can use it for other loans.